Liabilities include accounts payable, contracts parable, bonds, mortgages, notes payable, and any other debts. Liabilities are any legal responsibility you hold to pay debts or fulfill contractual obligations; loans, deferred revenues, or other accrued expenses. Since transactions display as individual line items, third parties can quickly view and assess your business’s core components (assets, liabilities, revenue, expenses). It’s a comprehensive list of all account numbers and names relevant to your operation.

- For example, within the expenses category, you may have subcategories for labor costs, materials, subcontractor expenses, and equipment.

- Examples include vehicle expenses for your workers, cell phones, uniforms, etc.

- Use a journal, spreadsheets, or construction accounting software to record day-to-day transactions like accounts payable, accounts receivable, labor costs, and material costs incurred.

- Managing the finances of a construction company can be complex, with numerous transactions and expenses to track.

- This method simplifies financial reporting, increases transparency, and provides a clear overview of expenses across different project components.

Revenues

You might have to rummage through a pile of paperwork, going through orders one by one for hours. What if you had to report on all accounts payable within the two months that followed – but suddenly realized that some documents are missing? The completed contract method is mostly used by owner-builders and ein number spec developers because the sale price is not known until the project is complete.. As transactions are entered into the accounting software, they are posted to the appropriate accounts in a double-entry system. Financial statements provide a summary of these transaction amounts for a given time period.

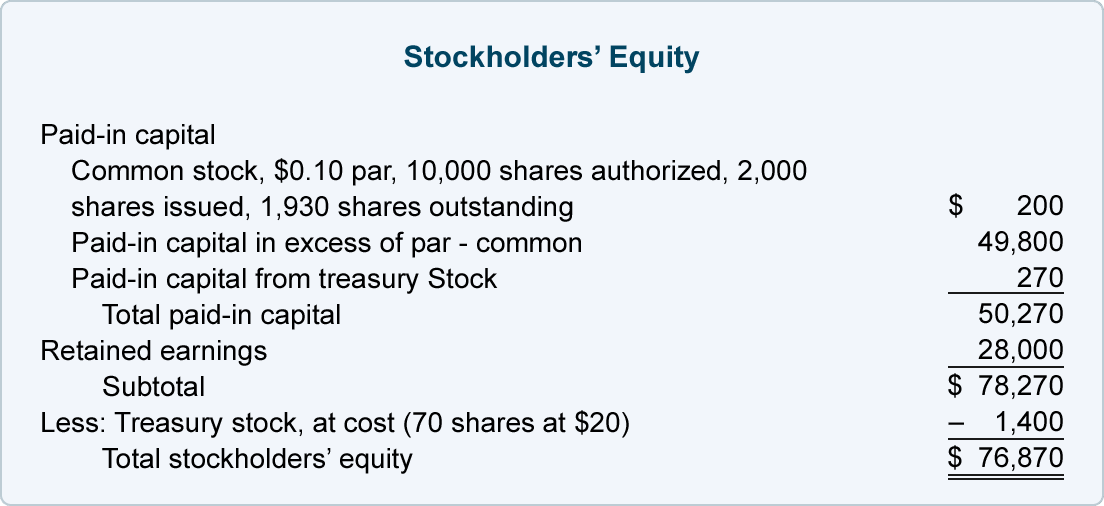

If your account structure becomes too complex, the entire accounting system will be affected and you may face additional accounting issues leading to clarifications and corrections. Generally, current assets are anything that can generate cash within 12 months, as well as resources required to continue your day-to-day operations or cover current expenses. Asset accounts belong to the first category on your chart of accounts, for example, Cash or Accounts Receivable.

Manage your inventory and bookkeeping easier

This free construction Chart of Accounts includes accounts for retainage, underbilling, and more, formatted for easy importing to QuickBooks. If you are migrating to QuickBooks from another accounting software platform, you can import your existing Chart of Accounts from an Excel (XLS or CSV) file or Google Sheets. In addition, the Chart of Accounts is used to build a contractor’s financial statements. Each account will correspond to a field on either the Balance Sheet or Income Statement. Meet a Knowify expert, get your questions answered, and start your journey today toward organized, profitable projects with Knowify. Subtracting COGS from total revenue is the surest way to determine your gross profit margin.

Overhead or operating expenses are the day-to-day expenses of running your business. These expenses include office expenses, office payroll, rent, utilities, vehicle expenses, insurance, taxes, advertising, and depreciation. It’s important to keep track of these expenses in order to accurately calculate your net income. Tracking your revenue accurately is crucial for billing customers and managing projects effectively. By separating your revenue how should an llc fill out a w into these categories, you can easily identify which areas of your business are generating the most sales and make informed decisions for future projects. As a contractor, your company may provide services such as construction, renovation, or maintenance.

Job Costing Integration: Aligning COA with Job Costing Reports

The chart of accounts is a foundational element of accounting that provides a systematic way to categorize and organize financial transactions within a business. It serves as a framework for recording and tracking financial activities, including revenue, expenses, assets, liabilities, and equity. Advanced construction accounting software helps you build a solid financial foundation for your construction business. With a proper COA supported by construction accounting software, you can accurately account for income and expenses, and also easily create reports to assess your company’s financial health. A best practice in construction accounting is to strategically use cost codes instead of creating excessive accounts.

They are grouped into categories that correspond to the structure of a construction company’s financial statements. A chart of accounts, or COA, is a listing of all the financial accounts in a construction company’s general ledger (GL). Accounts are grouped into categories that correspond to the structure of a company’s financial statements. The chart is formed by a list of numbered accounts with the account names and their brief descriptions. Managing the finances of a construction company can be complex, with numerous transactions and expenses to track. A well-organized chart of accounts is essential for keeping your books in order and ensuring accurate financial reporting.

The accounts in the list provide the structure for the company’s financial statements and are tailored to provide the cost driver information needed on those reports. Common reports for construction include the balance sheet, income statement, and work in progress report. Instead of using the COA to segment departments, divisions, or locations, construction companies should leverage the reporting dimensions available in their accounting software.